oregon tax payment address

District of Columbia Idaho Kansas Maryland Montana Nebraska Nevada. Oregon Tax Payment System.

Payment Plans Installment Agreements Changes To User Fees Oregon Association Of Tax Consultants

New wwworegongov Salem OR 97309-0910.

. Enter your Username and Password and click on Log In Step 3. You may send us tax law questions using one of the. Details are available at oregon.

Go to Oregon Tax Payment Address website using the links below Step 2. Internal Revenue Service. PO Box 3416 Portland OR 97208-3416.

Between the time that taxstatements are sent out in early October and November 15th if you have your payment stub the payment should be mailed to PO Box 10526 Eugene OR 97440-2526. 3 beds 2 baths 1786 sq. If there are any problems here are some.

Annual domestic employers payments are due on January 31st of each year. RMLS For Sale. Send your payments here.

Many companies will enter a generic tax dept email here. Where to Send Balance Due Tax Account Payments. However when we send our questions to generic emails our response rate is very low which.

04 Spouses last name City Contact phone Spouses SSN Initial State. Address For Oregon Tax Payment State of Oregon. 7 rows If you live in Oregon.

Oregon Tax Payment System Oregon Department of Revenue. Marion County Tax Collection Dept. Your browser appears to have cookies disabled.

Please mail property tax payments to. Payments mailed to this address are. Cookies are required to use this site.

For the contact person. The Oregon Tax Payment System uses the ACH debit method to make an Electronic Funds Transfer EFT to the state of Oregon for combined payroll taxes or corporation excise and. And you are filing a Form.

Cigarette tax stamp orders. Current mailing address Rev. Spouses first name Initial Spouses last name Spouses SSN Current mailing address State City ZIP code.

And you are not. And Indian tribal governmental. 20133 Coquille Dr Oregon City OR 97045 565000 MLS 22685988 Spacious one level home with great curb appeal in a.

Special filing address for exempt organizations. Copy of your Oregon tax return. Be advised that this payment application has been recently updated.

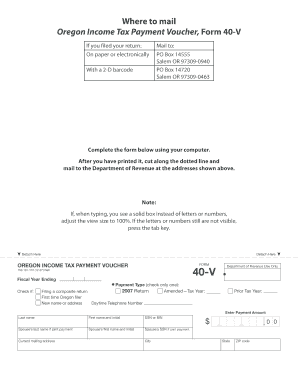

Benefits of registering on Revenue Online. Oregon Department of Revenue - Mailing. Form OR-40-V Oregon Individual Income Tax Payment Voucher 150-101-172.

Instructions for personal income and business tax tax forms payment options and tax account look up. If you live in. Estimated tax payments due june 15 2022.

Oregon Individual Income Tax Payment Voucher Page 1 of 1 Oregon. Your payroll tax payments are due on the last day of the month following the end of the quarter. Business Corporate Tax.

Ssn spouses first name initial. Your cancelled check is your receipt. Everything you need to file and pay your Oregon taxes.

Skip to the main content of.

Form 40 V Fillable Payment Voucher For Income Tax

Oregon Dept Of Revenue To Begin Distributing One Time Assistance Payments Of 600 Ktvz

State Of Oregon Oregon Department Of Revenue Payments

4 Reasons Why Oregon S Corporate Minimum Tax Is Too Low Oregon Center For Public Policy

Oregon Tax Revenues Surge But State Economists Warn Of Risk Of A Boom Bust Cycle Kcby

Property Tax Collection Deschutes County Oregon

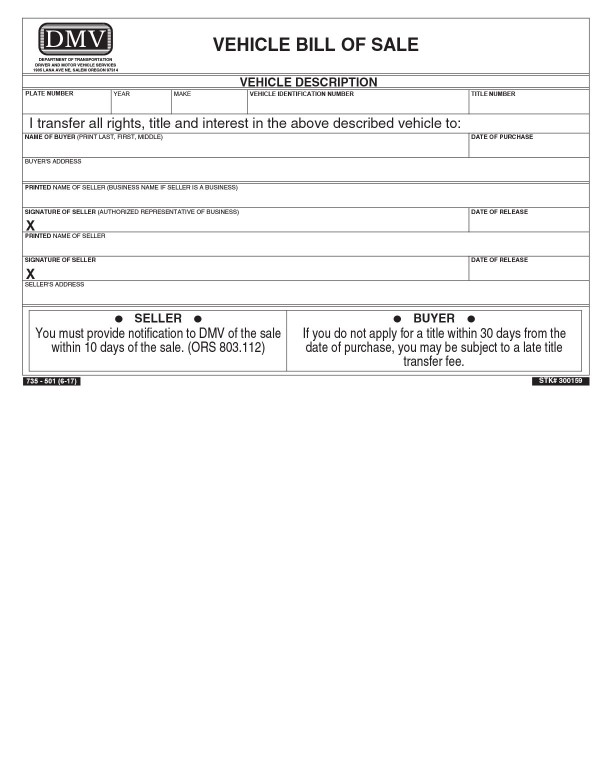

Oregon Bills Of Sale Templates Forms Facts Requirements For Selling Car Boat

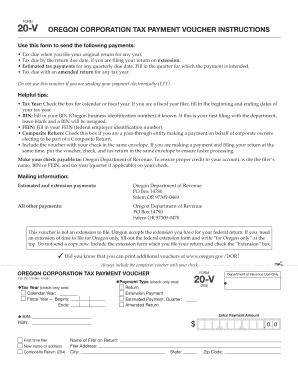

Fillable Online Oregon Corporation Tax Payment Voucher Instructions Fax Email Print Pdffiller

Oregon Revenue Dept Orrevenue Twitter

Human Error To Blame In 2 Million Oregon Tax Refund Scam Oregonlive Com

Oregon Income Tax Calculator Smartasset

Columbia County Oregon Official Website For Immediate Release Nr Property Tax Payments Due November 15 2021

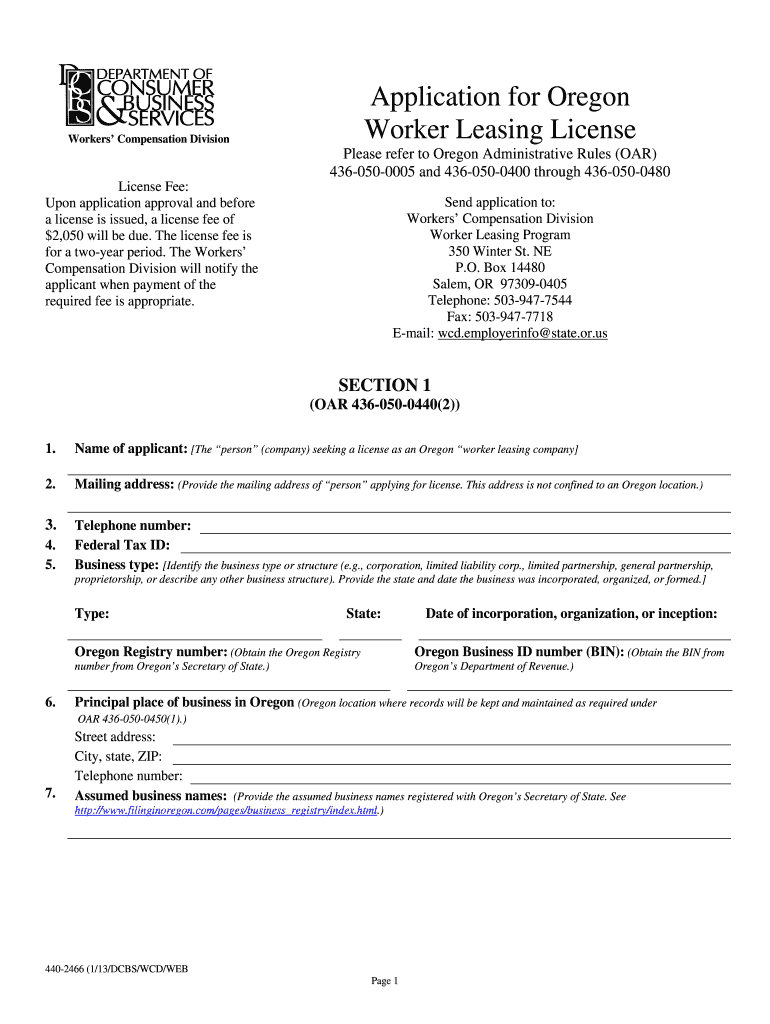

Oregon Leasing License Fill Out Sign Online Dochub

Oregon Highway Use Tax Bond Jet Insurance Company

E File Oregon Taxes For A Fast Tax Refund E File Com

Oregon Insight How Families Spent Their First Child Tax Credit Payments Oregonlive Com

Fillable Online Services Oregon 2007 Form 40 V Oregon Income Tax Payment Voucher 150 Services Oregon Fax Email Print Pdffiller